Palladium Metal Price and its Impact on the Hydrogen Economy

Updated Jan 31, 2024

Introduction: Unearthing the Palladium Enigma

Palladium, a lustrous silver-white metal, seldom takes the spotlight in the metals market. Yet, behind its unassuming presence lies a crucial element that holds the potential to shape our future in the pursuit of a cleaner, hydrogen-based economy. The current palladium metal price, which has experienced a significant drop recently, presents a compelling opportunity beyond mere financial considerations. It warrants a closer examination from the perspective of mass psychology and its profound impact on the emerging hydrogen economy.

Traditionally, palladium has garnered attention primarily for its applications in the automotive industry, particularly in catalytic converters. As a critical component in reducing harmful emissions from internal combustion engines, palladium has played a vital role in curbing air pollution. However, as the world shifts towards sustainable energy solutions, the relevance of palladium extends far beyond its conventional use.

The hydrogen economy, a system that harnesses hydrogen as a clean and efficient energy carrier, is gaining traction as a promising alternative to fossil fuels. In this transition, palladium is critical as a catalyst in various hydrogen production, storage, and utilization aspects. From electrolyzers for water splitting to fuel cells for power generation, palladium-based catalysts are indispensable for enabling these technologies to operate efficiently and sustainably.

The recent drop in the palladium metal price offers an extraordinary opportunity for investors and industry stakeholders to capitalize on this enigma. The market’s reaction to the price movement reflects the dynamics of supply and demand and the broader narrative surrounding the hydrogen economy. Changes in sentiment, market expectations, and investor psychology can significantly influence the price trajectory and create unique investment prospects.

Understanding the palladium metal price interplay and hydrogen economy requires a multidimensional analysis. Factors such as geopolitical developments, technological advancements, and regulatory policies contribute to the intricate web of influences shaping the market. Moreover, the palladium market is intricately linked to other precious metals, such as platinum and rhodium, further adding complexity to the equation.

In this article, we will delve into the intricacies of the palladium market, exploring the factors that influence its price movements and analyzing the profound impact that the metal’s price has on the development of the hydrogen economy. We will also uncover the mass psychology dynamics surrounding palladium and how investors can capitalize on the current market conditions to position themselves for success.

Palladium Metal Price Downtrend: A Contrarian Perspective

The recent downturn in the price of palladium may be causing some investors to feel uneasy. However, from a contrarian perspective, this could be considered an ideal time to invest. When the general sentiment towards an asset turns bearish, contrarians see this as an opportunity to invest, as they believe that the market may be overreacting and that a rebound could be on the horizon.

Contrarian investing is a strategy that involves going against current market trends. The idea is that when most investors are pessimistic about an asset, it may be undervalued, presenting a potential opportunity for those willing to take the risk This approach is not without its risks, but it can yield significant returns if the market sentiment shifts.

One strategy that contrarian investors might employ in this situation is selling puts. This involves selling a put option, which gives the buyer the right, but not the obligation, to sell a specified amount of an underlying asset at a set price within a specific timeframe. If the asset price does not fall below the set price, the seller of the put will keep the premium paid by the buyer. This can be risky, as the seller could face significant losses if the asset price falls significantly.

A historical example of contrarian investing is the stock market downturn in the early 1980s. During this time, the inflation-adjusted total return on the Dow and S&P 500 was negative, leading to widespread pessimism about the future of equities. However, those who invested in equities during this time would have seen significant returns in the following years as the market recovered.

While the recent drop in palladium prices may concern some, contrarian investors may see this as an opportunity. They could reap significant rewards by going against the grain and investing when others sell. However, it’s important to remember that contrarian investing involves a high level of risk and is not suitable for everyone. Always do your research and consider your risk tolerance before making investment decisions.

The Hydrogen Economy: Why Palladium is Gold

In the emerging hydrogen economy, **palladium** is more than just a precious metal comparable to gold. This is due to its unique ability to absorb up to 900 times its weight in hydrogen. This property makes it an indispensable component in hydrogen fuel cells, which are devices that convert a chemical reaction into electricity, with heat and water as by-products.

Palladium’s affinity for hydrogen is due to both its catalytic and hydrogen-absorbing properties. This means that palladium has the potential to play a significant role in virtually every aspect of the envisioned hydrogen economy. This includes hydrogen purification, storage, detection, and fuel cells.

In addition to palladium, platinum is crucial in hydrogen fuel cell technology. Platinum acts as the catalyst that converts hydrogen and oxygen into electricity. However, palladium’s ability to absorb large quantities of hydrogen means it has future applications in almost every aspect of the hydrogen economy.

Using palladium in hydrogen-based energy systems could provide a significant source of demand for the metal. This could substantially impact its price, similar to how gold prices are influenced by demand in various industries.

However, it’s important to note that the technology behind the delivery and deployment of hydrogen as a leading energy source of the future is still being developed. As such, palladium’s role in this future is not yet fully known.

Palladium: The Unsung Hero of the Hydrogen Economy

Despite the current price fluctuations of palladium, its value in the hydrogen economy remains undiminished. This precious metal plays a crucial role as a catalyst in hydrogen fuel cells, facilitating the necessary chemical reactions while remaining unaltered.

**Hydrogen fuel cells** convert chemical energy from a fuel into electricity through a chemical reaction with oxygen or another oxidizing agent. In these cells, palladium acts as a catalyst, speeding up the chemical reactions that generate electricity while not being consumed. This makes palladium an essential component in the operation of these cells.

The demand for clean, renewable energy sources is growing as the world moves towards a greener future. Hydrogen, as a clean-burning fuel, is gaining attention as a potential major player in this future energy landscape. As such, the demand for hydrogen fuel cells, and by extension, palladium, will likely increase.

This anticipated growth in demand for palladium could create upward pressure on its price. Just as gold’s value is driven by its demand in various industries, the same could be true for palladium in the context of the hydrogen economy.

However, it’s important to remember that the future of the hydrogen economy and palladium’s role in it is still uncertain. While the potential exists, the technology and infrastructure needed to realize this vision are still fully developed.

In conclusion, despite the current price of palladium, its role in the hydrogen economy makes it an unsung hero. As we move towards a greener future, the demand for palladium will likely intensify, potentially driving up its price.

Safety Factor of Selling Puts: A Deep Dive

While it may seem risky at first glance, selling puts can be safe and profitable with a thorough understanding of mass psychology and a contrarian approach.

Selling puts is an options strategy where an investor sells a put option, which gives the buyer the right, but not the obligation, to sell a specified amount of an underlying asset at a set price within a specific timeframe. The seller of the put option collects a premium from the buyer. If the asset price does not fall below the fixed price, the seller keeps the premium as profit.

The safety factor in this strategy lies in the premiums collected, which can be substantial during times of high volatility – such as the current palladium market. For example, one could sell puts on stocks such as SBSW with different strikes, deploying capital one lot at a time. Deploying all of one’s capital in a single shot is never prudent. You get in at a lower price if the shares are in your account. If they are not, you get paid for putting in a limit order, and the premiums can be pretty hefty.

Palladium’s Plunge: A Mass Psychology Perspective

The significant drop in the price of palladium has led to a market scenario where the metal is receiving less attention than usual. This is where the perspective of mass psychology becomes relevant. Mass psychology is a field of study that examines how the moods and behaviours of large groups of people influence markets and economics.

The principle of mass psychology suggests that the best time to buy an asset is often when there is maximum pessimism, as this is typically when prices are at their lowest. According to this perspective, the significant drop in palladium prices and the subsequent lack of interest from the broader market could represent an ideal buying opportunity.

The theory behind this is that when most investors are pessimistic about an asset, it may be undervalued and, thus, an attractive investment for contrarian investors willing to go against the crowd. This approach has risks but can yield significant returns if the market sentiment shifts and prices rebound.

In the case of palladium, the current market sentiment appears to be largely negative, which, from a mass psychology perspective, may indicate that now is a good time to invest. However, it’s important to remember that market trends can be unpredictable, and investing based on mass psychology involves high risk.

Palladium Price Trends: Insights from Recent Market Updates

Palladium is taking a hit, reminiscent of the patterns we saw in bonds, echoing what we’ve emphasised during the COVID crisis and before. As the money supply increases, these market manoeuvres tend to escalate. The manipulation we’re witnessing today was unheard of a decade ago, and ironically, it’s expected to intensify in the years ahead. We’ve discussed the reasons behind this multiple times, but for a quick reminder: firstly, these big players have so much money that they need to shake up the markets to enter and propel them to the skies to exit. Secondly, they seem to derive pleasure from seeing the masses react. Their perspective is different; dropping a million bucks is like spending 10 bucks. To them, it’s all just a game. Market Update November 12, 2023

Palladium is unequivocally a long-term screaming buy. The lower it descends in value, the more compelling the investment opportunity becomes. Nevertheless, it’s imperative to invest funds that are not crucial for daily living expenses and to commit to a time frame of at least 18 to 24 months. Success hinges on steadfastly focusing on the extended, long-term outlook and remaining unfazed by short-term market fluctuations.

Conclusion: Riding the Palladium Wave

As we stand at the precipice of a hydrogen-powered future, palladium emerges as a game-changing metal, poised to revolutionize how we generate and consume energy. Its unique catalytic properties make it an indispensable component in fuel cells, the heart of hydrogen-powered vehicles and other clean energy technologies.

The recent downturn in palladium prices, which saw the metal trading at around $1000 per ounce in January 2024, presents a compelling buying opportunity for investors with a long-term perspective. This represents a significant discount compared to its peak price of over $3400 per ounce in March 2022.

From a mass psychology standpoint, the current undervaluation of palladium creates a unique entry point for contrarian investors who recognize the metal’s long-term potential. As the world transitions towards cleaner energy sources and the hydrogen economy gains momentum, demand for palladium is expected to surge, driving its price higher.

Investing in palladium at current levels offers the potential for significant returns as the metal’s price rebounds and the hydrogen economy takes off. By riding the palladium wave, investors can position themselves to profit from this transformative shift in the global energy landscape.

So, as the world embarks on its journey towards a greener future, palladium stands as a beacon of hope, promising a cleaner, more sustainable tomorrow. For investors, the current palladium metal price presents a compelling opportunity to harness the power of this precious metal and reap the rewards of the hydrogen revolution.

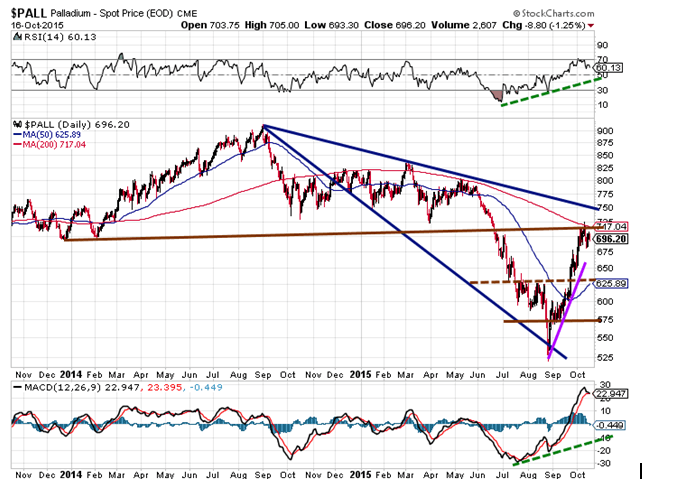

Palladium’s Price Journey: Insights from our November 10, 2015 Article

For a nuanced historical perspective on our aptitude in forecasting Palladium metal’s price trajectory, delve into the enlightening excerpt from our article published on November 10, 2015.

While the experts and everyone else obsess about what might or might not happen in the precious metal sector, palladium is being ignored in favour of Gold and Silver, which have done nothing but disappoint those waiting for them to open their wings and soar into the sky. Unnoticed, though, Palladium appears to have put in a bottom and is now attempting to establish a new trend. Our trend indicator is very close to triggering a bullish buy signal.

As long as Palladium does not close below 575 on a weekly basis, the outlook will remain bullish. Currently, it is facing overhead resistance in the 720-740 ranges. Failure to close above 740 weekly will result in a test of the 620-625 ranges, with a possible overshoot to 580.00. Either level would make for an excellent place to open new positions.

Use strong pullbacks to open positions in Palladium bullion. Palladium could pave the way for gold and silver.

Timeless Topics: Covering Classics to Current Affairs

How does consumer market behavior influence stock market trends?

Why should I invest in real estate?

What is conventional wisdom?

What Makes Howard Marks Second Level Thinking the Secret Weapon?

Federal Reserve Secrets: The Hidden and Controversial Actions Exposed

Market Fears: Turning Anxiety into Action—Seize the Moment!

What are the most insightful books about human psychology that everyone should read?

Stock Market Fears: Don’t Let Panic Rule—Opportunity Awaits!

Free Market Manifesto: Embrace the Chaos, Seize the Opportunity!

Is the market retracement meaning key to predicting price reversals?

Will the stock market crash soon?

What is a Limit Order in Stocks: An In-Depth Exploration

Are any countries on the gold standard?

Are stock market losses tax deductible?